The market is only down 11 points after 50 minutes as the US indices fell about 0.8% but recovered a good piece of the losses and IBM is trading up post market on a good result. The local index has stretched the low by a few points but wasn't willing to sell off, like yesterday, and the possibility of a reversal day is growing. This is something I was thinking about last night but I haven't been able to act on it. I really don't know why, maybe it's because I still have short positions on and that's skewing things.

Here's the XJO chart, down just 5 now..5 minutes later.

11.49 The provisional peak was at 4481, up 9, but with a muted start in China the index has eased to be down 3 which is quite healthy really.

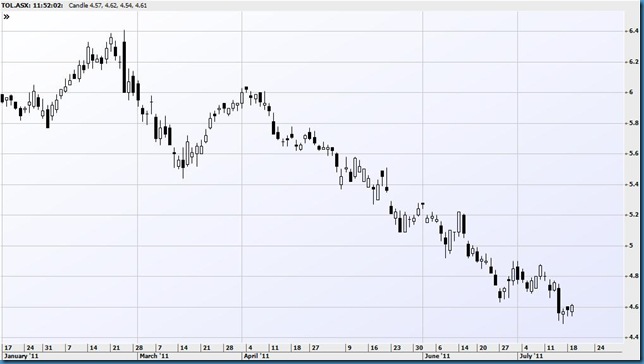

I'm reshorting TOL as it edges back up. My stop is at about 478 but I'd be concerned if it rallied through a recent swing low at 466 from last Tuesday. Just short a few at 455 and then 459. It's 461 now.

Actually, I did manage to take something off the table early on, selling 25 BHP July 4300 puts at 105 leaving just 25 left.

1.58 More of the same with the market wavering between small gains and small losses. I've cracked and bought back a few PDN at 238. I was worried about the stock bouncing back to the top of the range like most of my other shorts but I needn't have bothered, it's going nowhere intraday and still looks shabby on the daily.

2.58 Well, a day of lost opportunities as I couldn't bring myself to buy. The index chart continues to look quite positive in the very short term having just about broken yesterday's high and only being a few points short of Friday's peak. However, if it stalls here, it could tail off sharply in the last hour so I may as well just watch it now. The XJO 60 minute chart is below.

IPL hasn't done anything much since I shorted it at 385 the other day, looking for another leg down. I've jobbed around and cut the last of the short at 384.

4 pm The IBM result and subsequent lift in US futures hasn't made European banks any more solvent so the last hour did see an intraday failure (as European opening indicators are for a dead cat bounce) and a drop back into the red by a few points.

I lost patience in IPL at the wrong time and the stock has traded to 380. However CBA tipped over again. I sold out 25 lots of the put spread because it ends up being a binary equation around the 4900 strike and I wanted to take something off the table. My exit price of 106 for the 150 spread looked pretty good until the late slump in CBA.

4.12 It was quite a good day in the end but while I haven't bothered to write about every intraday trade, I managed to make a minor loss on the intraday stuff by just punting rather than waiting for a signal. I don't know why I do it, anxious, overeager..? I don't want to force myself to trade in a flowing way but I'm not sure what other way there is to get my mind to go with the action. I'm wondering if some sort of visualisation might work or it that's papering over the cracks and the better approach is to work out what unconscious motivation is trying to fight the market. I'll probably try both!

No comments:

Post a Comment