It's not quite that ridiculous idea, "The market owes me", but I do find myself scratching away at a trading idea when there are easier trades elsewhere. I've done it again this morning but rather than fret it about it too much, I've decided that I'll just do it in small size and get it over with. Kind of like nicotine patches.

It's a short in LYC at 196. The stock is in a mini bull trend and has defied market weakness over the last couple of days. I could easily (and more rationally) have taken a trading long this morning on the break of yesterday's high but I've got the idea in my head that it's due to catch up with the market. I'm using 201 as a stop and the stock is at 196.5.

The other trade is much more sensible as I look for a retracement rally in OST with minor buy signals on both the daily and the intraday charts. I got long at 192 and it's just sitting there but the market is coming back from an early 20 point gain so it's ok for now.

On the subject of trying to work with my intuition rather than battle it, I've also bought a few puts in NCM. They are the August 3750s at 44. I was trying to short the stock intraday yesterday and scrambled out for a few dollars. It occurred to me that one more push up for the stock might be enough for a 5 wave swing and a short term peak. There's absolutely no evidence for that but my risk is only $2200 out to August expiry and I wouldn't be comfortable shorting stock.

The broad market has just ticked into the red at 11.30 am with the HSI only up 0.6% compared to a 3% drop yesterday.

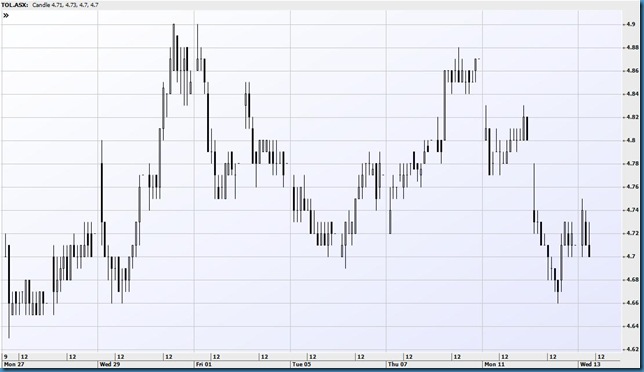

On a more systematic tack, I've added to the TOL short at 471.5 as the 30 minute chart indicates that a little retracement is over and the daily is weak. Here's the 30 minute.

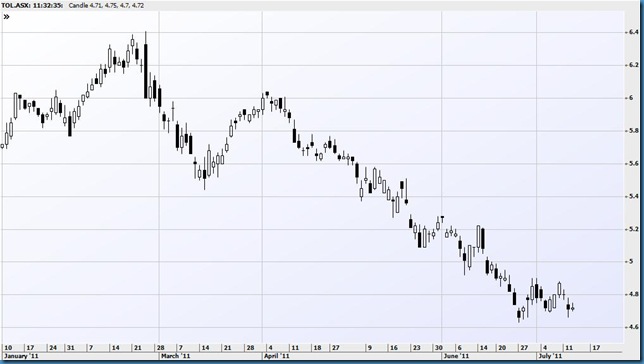

The daily is below, I'm looking for a new low and hope it's more than just a minor move to, say, 460.

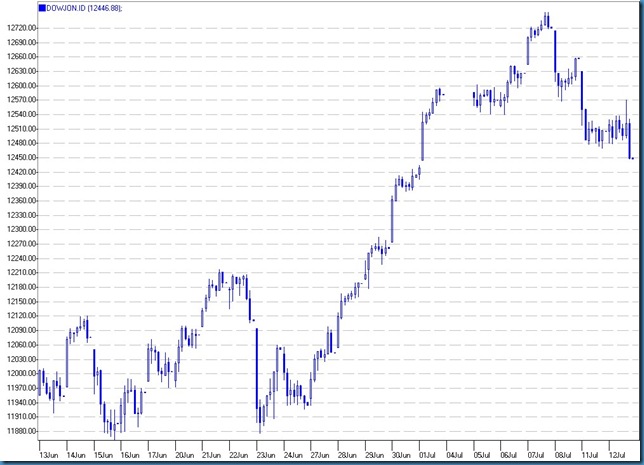

It was a tumultuous night in US trading with the indices tracking for a gain until the late downgrade on Irish debt by Moody's. I've got the DJIA 60 minute chart below and although you could look at it as maybe an "a" wave in 5 which could be due a little rally, my take is that the market could get hammered tonight, ie, the late move is the start of a 3rd wave as it expands into a larger pattern.

2.07 I had to pop out for an hour or two and I was pretty nervous because the market was rallying on slightly better than expected Chinese growth. Fortunately, I sold out of 50 CBA July 5050 puts at 128 and the same number of BHP July 4300 puts at 68 because the charts of the majors looked quite complete in the short term. I did this just before midday which was lucky because I'd completely forgotten about the Chinese data. This is what CBA was looking like on a 30 minute chart and quite a few stocks were similar.

I'm tempted to jump back into the CBA puts later on although the stock doesn't necessarily look weak for now. The market is up 30 points and could squeeze up some more.

4.11 The market was sold down 10 points in the match so the gain for the day is just 20 points. It's hard to tell whether we'll get another leg up (in the bearish scenario), today might have been enough.

My intraday trading was nothing to write home about but I picked up a few hundred dollars. It's becoming clearer that the aim with this might be to hold close to breakeven when it doesn't go my way, the good days should take care of themselves. If I can drop the whole wanting-to-be-right thing, returns should improve.

NCM went well, selling down from early strength.

No comments:

Post a Comment