After writing yesterday's post about the hedgehog and the fox, I had a thought about how my trading could flow more naturally but I wanted to ponder it overnight. It doesn't seem silly or unworkable after a night's sleep so here goes.

Essentially, I've got too wrapped up in sticking to my technical disciplines so that I quite often override my instincts. The thing is, the technical approach may be clunky but it works so I continue to deal with my intuition in a confused manner, sometimes using it when the technicals are in agreement and sometimes ignoring it when there's a mismatch.

If the fox is the maverick side, sniffing the wind and not really too fussed about systems, and I've forced this fox underground then eventually he's going to get out and cause havoc. That's pretty much what happened last month when I couldn't be bothered to cut anything and paid the price yet at the same time I still didn't pay proper attention to my instincts which could have kept me out of trouble.

Obviously, I'm relating this parable to the unconscious or the repressed shadow and it occurs to me that it will happen again and again until I restore the balance.

The funny thing is, I've been puzzling for a long time over why I find it hard to repeat the kind of flow that I'd often experience as a market maker. Leaving aside the obvious advantage that a market maker has of making lots of little trades with edge, I can see that there was a balance between order and instinct, or left and right brain, perhaps. When I was a market maker, I had very little time to access charts during the trading day and had to rely on gut feel, assessing order flow and body language etc etc. But at the same time, a market maker is driven by the pricing models, by trying to achieve a balance between calls and puts, time decay, gamma, dividend risk and finally tending towards a square delta even if a position is run for two or three days.

If I restore my instincts to their proper place, I hope that I can become more fluid. Of course, the trick is going to be differentiating between the unbalanced emotions of fear and greed and that simple knowing that is intuition.

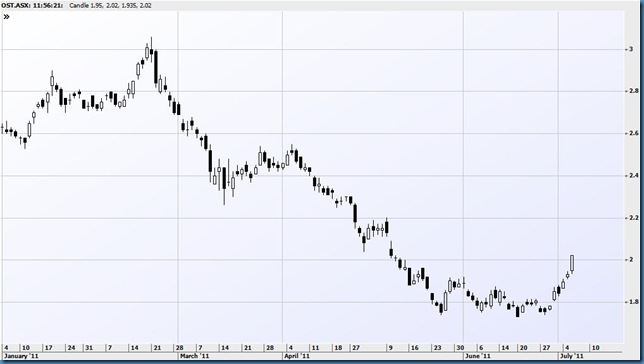

And how does that relate to my trading today? Not a lot, to be honest. I can't say that I have any astounding insights although I did have an inkling about OST the other day that I just didn't act on. the buy signal on the chart is obvious enough, I just figured that there was a big chance of acceleration at some point. If anything, the acceleration has taken longer to arrive than I was expecting.

The Asx 200 is rolling over but it doesn't necessarily feel all that vulnerable, I'm hoping for some more meat to the sell off but not necessarily expecting it.

I still have July 5050 puts in CBA and that's down 1% on the day. I was really tempted to add more yesterday but was hamstrung by having bought too soon. It may be due a couple of days of consolidation but it definitely looks weak and I guess that's my view on the market. It's going lower but maybe not for a couple of days.

The real standout trade was yesterday in NAB (and Monday, if you were particularly sharp). I saw it yesterday but didn't deal for the same reason I left CBA alone. It was an almost perfect gap fill in a down trend with plenty of room for a drive down to a new low.

I have a new long today in IPL. It's a stock I've liked for a while, it has a reverse head and shoulders look about it, it's due a short covering rally and US listed Potash, which is a similar sort of company, has been rallying. I'm long just a few at 386 but I don't feel completely comfortable with the trade. There has been only a mild sell off from the recent high and if the market rolls over it could easily drift back towards 370 without losing its bullish look. The reason I've bought a few is fear of missing out on a short squeeze; it's not a breakout but it's not a value trade and there's no especially enthusiastic buying despite a 3% rise in Potash shares overnight.

That was long winded but I've managed to work out that I shouldn't be in IPL here. I'd probably be buying on strength at 389, 390 but it's not great here. I'm on the offer at 385 and near the front of the queue.

There's a new short too. It's PDN, the stock is correcting, it's the second leg of the correction and there's precious little momentum to the buying. I'm short at 264 and I think that the trade is strategically good. My fear is that the stock is vulnerable to a squeeze as part of the same post June 30 paradigm of heavily shorted stocks recovering. I'm also concerned that it's stronger than it "should" be and I know that Deutsche bank upgraded it to a buy today (despite lowering its target price).

Despite feeling that I've gone a tad early, I'm pretty confident with this trade so I'm prepared to deal with delayed gratification.

As it happened, IPL gathered strength throughout the afternoon so I bought back in at 389, for a full amount. The stock closed at 390 and did that thing where it touched the recent high at 392 but didn't breach it which means it could be a minor double top.

No comments:

Post a Comment