I'm pretty tired after staying up to watch the most exciting stage of this year's Tour de France and feeling as foggy as one of those Alpine peaks. One thing I do remember is a comment a couple of days ago, about a young Norwegian rider called Boasson Hagen, to the effect that he doesn't take losses to heart and just gets on with it the next day. Laboured trading analogy alert, I know, but I have noticed that after a big losing day I quite often follow it up with more smaller losses. It means that I haven't really accepted the loss, or even the change in market direction, and in hindsight the initial bad day doesn't look like such a big deal, the problem was the failure to take my medicine and move on. The best thing about this week is that I had a medium sized down day on Wednesday because I was fighting the obvious market turn but I have at least embraced the change and today is a nice recovery for me with the market up 43 points and most things moving, even the short in NCM is performing.

I was concerned that the first leg of the bounce was over but it isn't. What was wrong with my analysis? Not necessarily wrong...there wasn't a sell signal on the 60 minute chart that I highlighted on the close, just the threat of one. 2 times out of 3 there would be another leg down but fortunately, today has seen an extension/expansion of the move and increased the possibility of a short term lift above the recent peak at 4657.

Another day, another couple of buys. The first is in Boral. Wednesday's rally took it through resistance and the break of yesterday's pullback has given me an entry at 428 on a potential higher low. I'm using a tight stop below yesterday's low.

The second is in Linc energy. I usually don't need much excuse to buy this one but I've been pretty sceptical lately; the move back below 300 after a long build up to the breakout was not encouraging and then I, sort of, smelled a rat. The company just announced that a US oil acquisition had fallen through over title irregularities and maybe that was the rat. Since then, the stock is shaping up more positively so I've bought 10k at 290 with the idea of buying another 10k if it can push on.

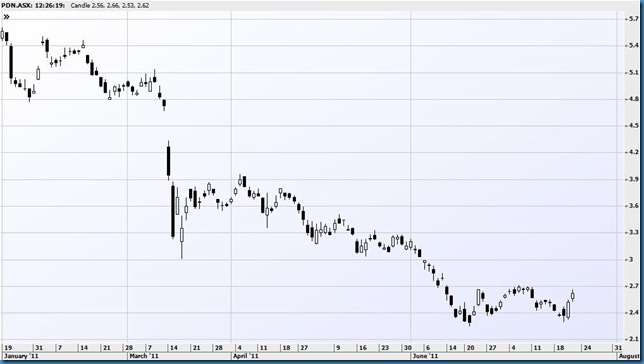

12.20 Although I missed the bottom in PDN, immediately after the quarterly report, I was right to cut the position. I can't quite put my finger on why I lost patience, I was questioning myself but ultimately it was a feel thing, the selling seemed lacklustre. It has rallied sharply to 262 on a short squeeze, I'd guess. Could I have traded the reversal? I was interested yesterday but missed the jump and since there are plenty of other buy signals around, I let it go.

FMG is up at 660 but hasn't set the world on fire. I think there's a large holder selling down slowly based on substantial shareholder notices but the selling gets soaked up. I was looking for something more explosive though and spent a tad over a thousand bucks on 300 (30 in the old contract size) July 675 calls which expire next Thursday afternoon. What I want is a move similar to the one in AGO, which is similarly favoured by analysts. Here's the FMG daily followed by that of AGO.

AGO

1.58 BSL is kicking on today and since I only bought 30k and sold 5k at 128 this morning, I decided to buy Aug 130 calls at 7. The first rally broke resistance and unless this turns out to be a pennant correction, this leg up can easily get to 145, 150.

NCM is heading lower again. I sold out a couple of the July 4050 puts at 62 when it was consolidating since it's expiry next week and a little consolidation would wipe these out. And I've just sold the rest at 76, leaving some July 4000 puts. Here's the 60 minute chart.

3.32 I bought more LNC at 292 which was the break of Thursday's high. The stock is up to 298 and, I suppose, a break of 300 would be back into bullish territory again. PDN is up to 268, 6%.

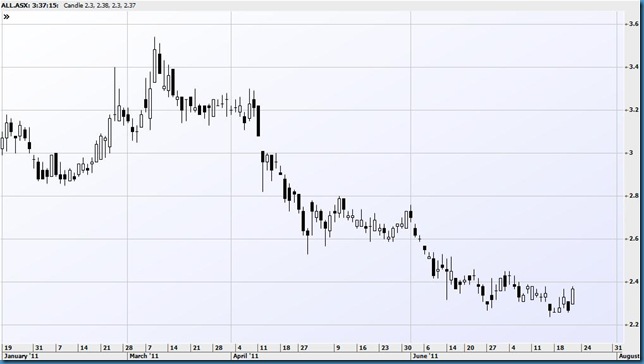

ALL looks like a no brainer but it has been poison for so long, that I can't bring myself to touch it. Also, I'm long more than enough.

4.13 That was a nice end to the week. The market finished up 1% at 4603 and all the positions went well. Let's hope for more "risk on" next week.

No comments:

Post a Comment