I thought it might be interesting to trace how I felt about the QAN trade on Friday afternoon. The first thing was that I rushed into the trade once I identified it. The stock is very liquid and the risk of missing a big move is minimal. I paid 186.5 when a little patience might have got me a 185 entry with the stock trading down as low as 183.5.

So I'm immediately kicking myself for rushing in like a beginner. While I was watching the stock pullback it also occurred to me that it was another trade where I'm trying to make the hard dollars on a retracement rally rather than the easy money on a trend resumption. Another opportunity to berate myself.

I think this kind of regret is quite common, I know that in my family you could never be good enough however hard you tried or well you did. You could argue that this kind of mental conditioning allows me to be critical; to see how I can improve my entries, for example. I don't see it that way. It's not balanced criticism because it always starts from the negative and the standards are impossible. ie. I may be aware that my entry was hasty but why is it still happening after all this time? Is it a fact of life that sometimes an entry will be hasty or is it the feeling of being under pressure that limits my ability to relax and trade freely?

The interesting thing is that I dragged myself out of the negative mind set by reminding myself that (a) I had entered the trade on a break in the 30 minute chart which was as rational as the sharp reversal was unexpected and (b) I knew very well that it was a retracement trade and thought that there was enough upside to warrant the risk.

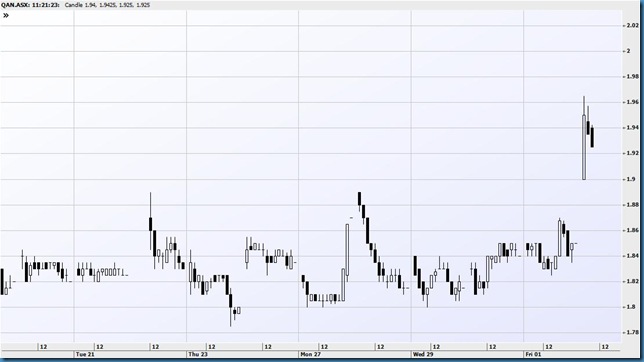

Here's the 30 minute chart, on Friday afternoon as the stock traded at 185.5, it made an intraday buy signal which indicated that the short term was backing up the daily picture.

Once I'd calmed down, I also realised that the new financial year changes the game for stocks like QAN which had been under pressure with tax loss selling and finally, the problems with rival airline Tiger would be a nice little short term boost for Qantas.

The story this morning has been of a big bounce in the stock – as you see from the chart above. I got out at a subpar 192. I correctly identified that bounces in QAN tend to quickly ease off but I didn't wait for, say, a 10 minute chart consolidation. Again the theme emerges of being impetuous.

What have I learned from this? Supposedly I'm a technical trader, dispassionately making a trade based on the probabilities following a chart signal with, perhaps, a little bit of general knowledge and experience to help me avoid some common pitfalls. The reality is that I see each individual trade as somehow being a test of my skill and self worth. This is ridiculous and completely at odds with the whole casino – or market maker – notion that each trade has an edge regardless of the ultimate outcome; you don't take any of it personally.

No comments:

Post a Comment