It's not a proper word but "stuckness" is how I'm thinking about it. I could feel the inertia but couldn't bring myself to buy as the market turned around super slowly over 3 days. It reminds me of that scene in the first Austen Powers movie where the henchman is crushed by a very, very slow moving steamroller.

What's the solution, apart from laughing at myself? To quote Sgt Schultz from Hogan's Heroes, "I know nothing!" What I mean, is that I would do well to yield to the market and just respond. I've been trying to think of imagery too. The popular image is of the sea and waves, which is a good choice visually and also from the traditional use of water as representing emotion and the sea representing the collective mood. But in some cases, this image is too amorphous for me. I'm looking for something more alive, maybe not a frightened rabbit, I suppose the popular herd image could do it.

The reason I want an image is that I think it would allow me to step away from plans and systems and take account of the flightiness of markets. Just when you think one outcome is a certainty, the market will turn tail and head in the other direction and rather than fighting the move, thinking of an animal and its movement might allow me to simply accept it.

Anyway, we're just about to open after a super strong overnight lead with the kicker of political deals being brokered in Europe and the US...maybe.

11.17 77 minutes into the trading day and the market has gapped up and stayed there. Up 71 points with the banks all bouncing 2% and the big miners getting close to that. While I can still see topping formations in major world indices, I think all bets are off on the short side in the short term. Here's the XJO.

I'm doing something which I really wanted to do yesterday and, of course, it was a much better buying day. Anyway, I'm clearing the decks so I'm out of the last BHP puts at 40, PDN at 244, OSH at 680, the last of the CBA spread at about 75 and TOL at 470.

I've also turned FMG into a bullish position, buying stock at 652 against July 650 and 625 puts. This has had a long pennant correction, I think, and a break could be quite explosive. Or rather, it has broken and after some consolidation, I expect it to surge. I've also bought some Aug 650 calls at 26 and some July 675 calls at 3.5 for a cheap kicker if it does go hard.

12.03 I've been pretty sceptical about LYC lately but it has actually outperformed the market during a period of weakness and given that it should normally swing more sharply in both directions – high beta – that's very good. A weekly chart, below, shows that over 3 months the pullback has so far held above the peak of the big 2010 move (mostly) and the potential for a higher low is there.

I've bought at 195.5. The 60 minute chart shows a break, albeit with a gap, and so far it has declined the opportunity to fill the gap.

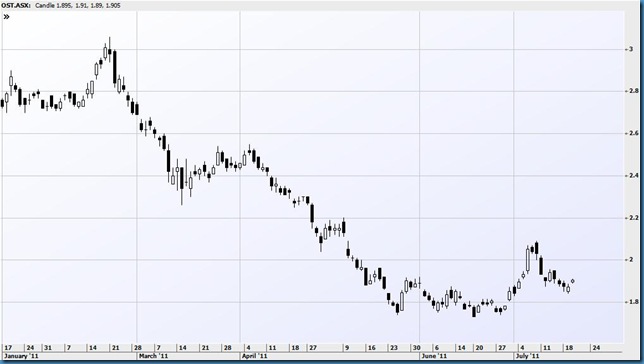

OST is another fresh long at 190.5. The recent recovery broke through resistance before pulling back while the retracement, by contrast, has held above support.

1.27 Ouch! Just got back from a vey quick lunch. PDN has issued its quarterly and been sold down sharply, last at 232.

2.18 Bought and sold some PDN to scrape back a few hundred bucks.

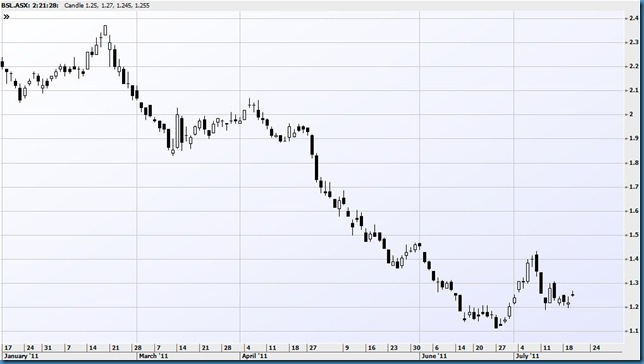

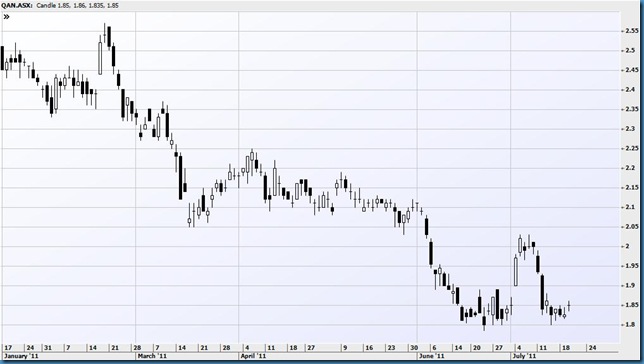

Today is just buy signal after buy signal (in my terms!) and since we're coming off a low base with that compressed spring look about the Asx 200 chart, I figure there could be a couple more good up days and I'm taking the signals. So now also long BSL and QAN.

QAN.

A note of caution is the underperformance in China with worries about reporting season offered as a reason. It has kept the gains in the Aussie market to a touch under 70 points on a day when I thought we could rise 100.

4.12 The market closed up 82 points. It was quite a good finish because European opening indicators are muted with a headline saying that Merkel was talking down a Greek debt compromise. There wasn't much change in my new positions, the market had already gapped up so that was to be expected.

No comments:

Post a Comment