It has been a few years now and I'm still undecided about whether to be super patient or super active or both with different positions. Each approach has and hasn't worked at various times and I often feel that too much activity is counter productive.

But I was really bored yesterday and I either have to become an overnight trader who looks at the screens a few times a day and does something else the rest of the time or make the most of the time I spend in front of the screen and the skill set I've built up.

I'm not making any rash decisions for now because I'm clearly not going to keep to them until I've sorted it out more. Part of that process is to set better ground rules for my active trading and there are a few key points.

1. It mustn't affect my position taking.

2. It can't be too intense; once in the position there's a stop level and an exit strategy and an understanding of whether to hold overnight if neither event happens. Ideally, I should be quite comfortable to hold overnight because I'm not trying to scalp a countertrend move.

3. Don't punt options! I never cut them and then bleed slowly over days.

4. Don't punt the SPI! I go into an intraday frenzy and wake up at 4.30 pm when the futures contract closes having given up most of the early profits.

5. WAIT. Keep an idea in mind and see if the market agrees.

6. Think about the trade which the market really isn't expecting, doesn't want or is fed up with waiting for. This is the one that my intuition will normally pick out but I often ignore.

The scene was set for a firm open with another strong US lead and I had no real opinion as to whether we would sell off after the opening or firm on the back of expectations of a good US jobs number or do neither. It was relevant to one of my positions but not the other and in the end both trades were worth doing anyway.

The energy stocks have been pretty hard hit in Australia because of cost overruns on LPG projects and WPL is one of the worst performers. However, it very much has the look of a higher low about it.

Most of the larger energy stocks had a similar look and I could just as easily have gone into STO. But WPL was very cautiously up early (STO had gapped too far) and there was a fair bit of exploratory volume around 4100, just 10 cents up. The 30 minute chart had a buy signal and once it seemed as if the stock wasn't going to fail, I bought at 4105. My stop is 4080.

Obviously I'd love a short squeeze in this so I can take some profit today but I am happy to hold overnight.

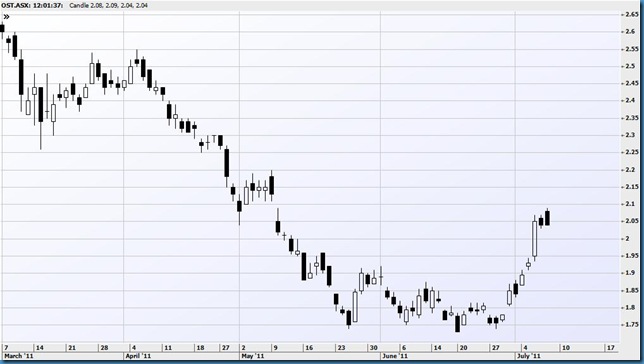

The other trade is a short in OST. It has already had the big squeeze, the details are not out but it is believed to have achieved exemptions of some sort on the carbon tax and after a gap opening there was no follow through. I'm short at 207 with a stop at 211 but I wouldn't want to be short it overnight if it couldn't trade down below yesterday's 203 low.

My overnight positions are mostly good with IPL having leapt 3% to 401 while the short in PDN is up just 2. BHP was well bid overnight and has continued the rise. My long puts have cost me as they're down to 17. It's the same old story where I think that since there's 3 weeks to go and they're worth scraps now, I may as well just hold on to them. So, next time I even think about it, I'll give myself an uppercut.

3.04 There are plenty of bullish looking charts about now but in most cases the horse has bolted. I'm out of half of the OST at 201 as that trade has gone pretty well. Although I could now hold the balance overnight, I prefer to buy it back by the close as the carbon price details are something of a wildcard.

WPL is at 4123 and hasn't moved much since late morning. I expect I'll hold that overnight although I will sell out a third as the position is larger than normal.

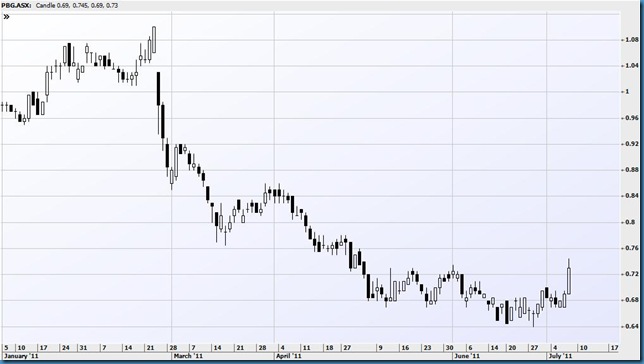

The new game is for the out of favour stocks to bounce back hard and it's the turn of PBG today. Normally I would feel that it was too late for this trade but following the template of BSL, OST and QAN would imply a bounce to 80ish. Long at 72.5 and hoping to get out on Monday or Tuesday.

This PBG trade is an example of being fluid, two weeks ago I wouldn't have touched it and now it's more of a bull market set up where these trades usually pay off. The context is the point and trying to be too systems driven can make for lost opportunities.

Talking of bull markets, it occurred to me a while back that the chart for the DJIA could be due to make another high. The weekly trend channel would look pretty complete if it could get close to 13000. Since the interim low in July 2010, you could see it as a 5 wave completion with an extended 3rd wave (in 5). That would mark the end of the post GFC recovery and it makes sense if you think that QE2 is over and once the hot money has moved out of bonds, you may not get much fresh buying. Of course, the renewed optimism about the US economy might change all that.

No comments:

Post a Comment