The Asx 200 is continuing to perform steadily, shrugging off a weak overnight futures lead - which was at odds with overseas indices - and spending most of the day higher. It's not a massive move but my long positions are generally responding pretty well.

The main short term interest is with NAB March 2400 calls because they expire on Thursday. The stock has broken through last Monday's high to be trading at 2450. The move is not a dynamic one but NAB has done a bit of work intraday and the sector is continuing to lead.

The options cost $3300 and being in the money, it means I'm long 15,000 stock or $360,000 worth with the downside being intrinsic value above 2400 (plus a couple of cents of remaining premium). It's when options use can really stack up.

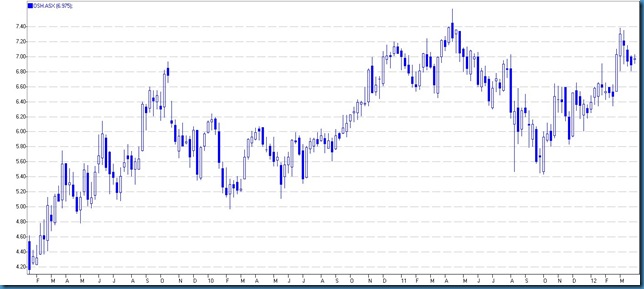

I've also used calls to go long OSH. They are the April 725s, bought at 10 and then at 8.5. The weekly chart, below, shows an uptrend with a three week correction which held above previous highs reasonably well. I'm hoping it's a simple correction rather than a three wave job and a move to a new high would take the stock price to around 750.

The daily chart shows a shallow correction which has held above 680, a recent support and resistance level.

4.12 The market sold off in the last half hour to be slightly down and then copped another 6 points at the match out with banks being sold down. The result was a loss of 8 points to 4263.

No comments:

Post a Comment