I was given a Kindle, an ebook reader, a few months back and I've taken to it. It's a convenient way to read, quite pleasant on the eye, and you can download new titles in seconds. Older books are often free or very cheap and I downloaded a book called "Think and Grow Rich" by Napoleon Hill. It's a well known book, loved by millions and although there's a lot of padding, I really enjoyed it. It was a well spent dollar!

Among other things, the author stresses the need to define very specifically what you want and I realised that I hadn't had an ambitious trading target for a long while. I'd been focussing on what I need to make to keep the business ticking over and that has tended to be what I've made. I don't mean that I haven't had ambitions to make more but not clearly defined, very specific goals with a plan and a burning desire for those goals. I think back over the years and my best trading years have coincided with just such a passion. When I was aiming to strike out on my own, I was determined to build a pool of money and had my best year by far.

I've actually been thinking about what I want for a year or more and although the main themes are in place, the financial side was unclear. Essentially, I just wanted to pay my ongoing expenses and anything extra was a bonus. I have property and couldn't really think of too much more in the way of material wealth that I really wanted apart from money for travel and some house renovations. Anyway, after some thought I realised that I do really want an investment portfolio. I'd love to have a large pool of money to invest in a patient way. So there it is and now I'm really fired up to go out and get it.

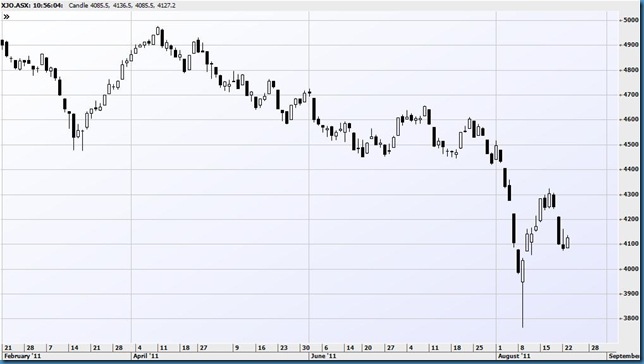

As for today, another rollercoaster ride had European markets heavily down on banking worries before reversing to finish strongly up. The US indices, helped by an improving employment picture, had a strong day too and closed up 4% or more. Having run ahead for a few days, the Asx 200 has done well to be holding a gain of 60 points at 11.44 am. NAB has firmed up and taken the edge off my put position but it's a subdued move and has not even gone above yesterday's intraday high.

My trading plan is to trade only high conviction ideas on an overnight basis, trades that I can put on in bigger size and to limit the number of these to three. During the day, I plan to look for intraday opportunities early and try to wrap them up by lunch. Sometimes it may make sense to hold them for longer but I don't plan to be putting on new trades in the afternoon.

I didn't have high hopes for this today with the likelihood of a gap open and then a stalling market but I've put on a couple for negligible benefit. One of these would have been good but I got unlucky/impatient and the other was a reasonable opportunity which I cut well when it didn't go my way.

The steel stocks have been doing it tough and BSL announced write downs last night. The stock is heavily shorted and after a minor blip up at the open, it was sold down to 92. That couldn't hold and the price pushed back to 96. I thought there was a good chance of a short squeeze and a sharp reversal the other way. It looked on the cards for an hour or so and the stock got to 97 but eventually I cut at 95.5. It's getting crunched now so I definitely could have cut and reversed.

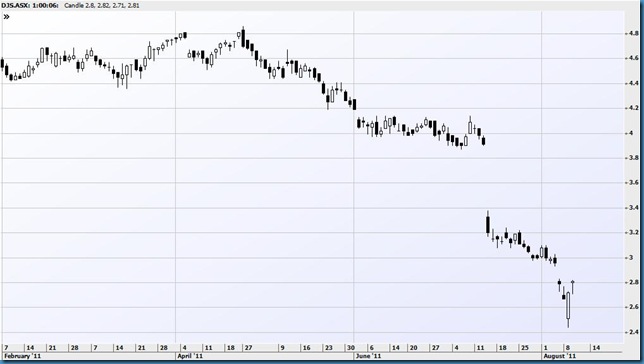

DJS is in another struggling sector, retail, and sold off yesterday on a downgrade. I was looking to sell into a rally. There was some minor volume up to 278 which surprised me but then selling appeared. I got short at 270 but was trading a 10 minute chart. I cut for breakeven after the stock recovered only for it to slump again. I bit the bullet and re-shorted at 264 so I've missed out on 6 cents there. The stock is at 262 now. It was a marginal call to cut at 270 but the market was strong, there was that early buying in the high 270s and I just want to get in the discipline of cutting these trades. I was anticipating a retracement to 272-274 and hoping to resell there, if the momentum stalled.

Here's DJS on a 60 minute chart. It looks pretty weak so this is one of those trades I should hold for longer.

1.50 The market is easing off but remains higher by 44 points. I've bought back 10k of DJS at 260 and have 20k left, with the stock having found some buying but no bounce at 260. NAB is back down to 2300, up just 10 now.

I can't really see any real high conviction trades to put on. I wouldn't mind shorting one or two stocks but I think I may be premature. I'll have another look in the last hour.

2.46 Out of the balance of DJS at 262 as the stock found some buyers with large lines being crossed.

I've put on an overnight trade with a short position in AWC at 182.5. Reaction to the company's profit result was negative and it looks like a pennant type correction over the last few days.

4.13 The index closed up 32 after flirting with the possibility of selling off to a flat finish. AWC eased to 180.5 but found some late support to close at 182. If the stock rallies through today's high of 187 then it's probably not going to be a pennant correction and could push up towards 200 so my stop is at 188. Here's the 60 minute chart.

It was a nothing day but I'm pleased to have made a start with my plan of limiting any intraday trading to early in the day. I could have done better with BSL and DJS but made money overall (along with a small positive trade in TOL).