So much for being able to short rallies, the index is set to open down more than 3% as the debt crisis unfolds with the Great Depression comparisons dusted off yet again. Anyway, it's reminding me how easy it is to undo your good work when you lose sight of your method. I still have long positions which I've held well past my stops and they'll have to go...so, it must be the bottom! I'm not looking to sell on the open, that would usually be close to the intraday low although the momentum of the selling in the US might suggest another big down night and no real bounce.

Apart from the unresolved loss issues I wrote about yesterday, the other reason for my recent missteps has been confusion about where I want to go with my trading. The best thing I could do is step away and think about what I want, how active, what time frames etc. I'm not worried about profitability going forward, it's pretty clear that recent issues are not with my approach, but I do want to resolve why I periodically fall off the wagon in terms of sticking to my guns and work out how to fix it.

11.07 The index is down 165 or 3.9% at 4111 with a low at 4097. The Asx 200 flew through the previous lows at 4175 and is not far from the next support level at 4079 which was set in June 2009.

It's a full blown panic and isn't over yet. The financial stations are talking up more carnage on a disappointing jobs report which everyone is now expecting.

12.20 You really see how effective the market is at emotional valuation on a day like this. I had the usual thing where I woke up in the middle of the night and thought "I bet you the US market is getting smashed" and sure enough, the DJIA was down about 350 at that point....not psychic, it's just that I'm away from all the noise and self deception and it's not hard to read the signals then. Anyway, when I woke up with the alarm to find the final number to be a loss of over 500 points, I wondered who would possibly buy on a day like today with the US market fall seemingly incomplete. But with the opening drop of 4% here, I start to weigh it up and think there are bargains around. What if the US payrolls numbers is not as bad as feared, or the worst is already built in?

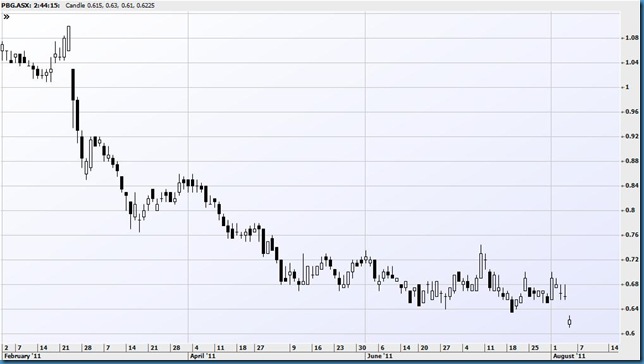

2.41 One of those typical crunch days where the market gaps down then goes nowhere. Lower by 4% as we have been for most of the day. I'm out of most things but have half of the PBG left. I sold half at 62.5 which is not bad considering, possibly some yield support. I'll probably sell the rest though as the best thing I can do is – stupidly, belatedly – clear the decks and wait for trades to come along on my terms.

3.02 The market looks totally oversold and ready for a retracement rally but since it's still the 3rd wave and I've spent too much physical and emotional capital, I've had to stop out of everything. However, there will be opportunities with this sort of action going on.

4.11 All over for the day. I don't suppose it matters but having sold my longs, I'd like to see further weakness tonight. US futures are flat with European futures down 1.5 to 2%.

No comments:

Post a Comment