The US market left it late but finally had a very strong reversal so that the market here has kicked on another 2.7% at 12.26 pm. My phones and computers have been down for most of the morning so I haven't been able to do anything. The market gapped up though so I don't think there was much for me to do as I had a clean slate again.

The market is back to 4143 and there could be a day or two more of rally. Obviously, it could be a V bottom with plenty more to come but I'm going with a 5 wave down expectation which would make this the 4th wave recovery. However, when the sell off has been so abrupt, it's possible that the 5th will fail so there could be a higher low in the event of another sell down.

I just sold out half of the DJW position at 350 and I've put on an intraday long in LNC at 227. I traded LNC intraday and it was one of 2 or 3 stocks that I considered holding overnight. I wish I had, it's had a 15% bounce. I'm long it on a 30 minute signal with a trailing stop. The daily chart shows that there's more room to move for a retracement. First the 30 minute.

And the daily, I'm hoping for 240 today if it keeps going but it's already run very hard.

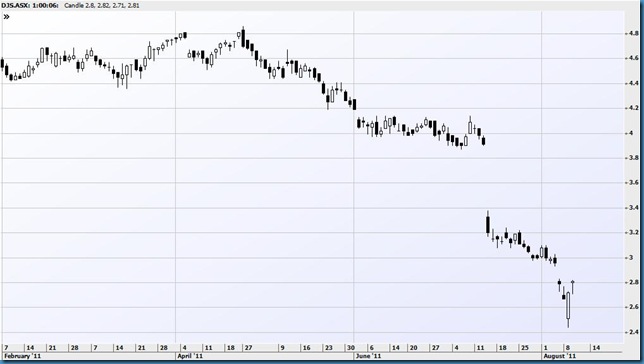

12.51 The market is firming again but it's much more tentative than yesterday. I've also gone long department store operator DJS at 279. This stock has been slaughtered recently after a downgrade but HVN has just surprised the market with flat sales for the year and the stock has rallied 8%. That may or may not be helping but the 30 minute chart looks pretty good with a sell off from an early high and then a breakout following a minor congestion. Stop is at 275.

The daily chart shows that DJS almost halved between late April and yesterday morning.

1.42 The market is solid but not kicking on and we're outperforming Asian markets over the last couple of days so I'm out of LNC for an average of 232.

2.05 The index is flatlining. I'm out of the rest of the DJW at 348.

2.32 Out of DJS at 280 as the market is topping out. LNC have just sunk to 220 so that was in the nick of time. I think there's more in the rally but it's too hard now and I'll wait till something good turns up.

3.51 I've found myself getting sucked into doing intraday trades and have chopped in and out of a few stocks to no great effect. Yesterday it was worth going hard all day but those days are few and far between. I normally find that there are a few opportunities in the morning but it's hard going in the afternoon.

I've decided to go long OST as an overnight position at 145. I don't necessarily think that this has made a bottom but there's a lot of room for a retracement rally, it's heavily shorted, it reports on the 16th and it's cheap, even in this market. Chinese steel mills are going full bore to cope with construction demand. Here's the daily. It's a reversal trade with a worst case stop below yesterday's low at around 127. The entry was a break of yesterday's high, I missed the best because my system was down but it moved in a tight range all day so the buy price is ok.

4.14 The Asx 200 closed at 4141, a rise of 106 points. I have one position in OST and that's it. The rally has almost gone far enough if it's going to be a simple retracement but the chances are good that the US indices will have another day of recovery so we could get some follow through in the morning.

No comments:

Post a Comment